Since 2009, Flipkart has raised over $550 million and the latest fund raising is a telling tale of how Flipkart is the runway leader in e-commerce.

Flipkart raised total $360 million from the fifth round of funding, which values the company at $ 1.6 billion. Flipkart strictly has no comparable in the listed space. But its relevant enough to give the contrast in the buoyant valuations of private equity space vs the depressed valuations of secondary market. We have attempted to compare it with the off-line retailers and Just dial (which is the one of the two listed e-commerce plays available)

Flipkart v/s Offline Retailers: Stark difference in Valuations

Flipkart is worth more than the total market cap of all top 3 listed Indian retail companies Future Retail, Shoppers Stop & Trent combined. These companies have a Market cap close to Rs 9000 crs whereas Flipkart is valued at Rs 9600 crs. To compare apple to apple, off-line retailers have a big debt and hence we should compare Entireprise Value (Market Cap Debt). Enterprise Value of these 3 companies combined on consolidated basis comes to around 14,500crs. Flipkart benchmark valuations have been established by suave private equity players, who we assume have not been euphoric while valuing the company. Why is it that PE players want a piece of Flipkart while the entire listed space goes for a song?

Growth

Flipkart sales grew by a robust 178% in FY2013 to Rs. 1345 crs. There has been a strong growth in Sales. On the other hand, retail sales in the economy have been decelerating.

Profits

Flipkart has succeeded in building a scale and looks like an early winner in E-commerce, which is an emerging growth area. So even though currently the losses have increased for them from 62crs to 192crs, business has reached a stage from where the operating leverage will kick in and it can be expected that they will turn in a profit over next 2-3 years.

Business Model

Flipkart is a pioneer in Ecommerce and early success thanks to its aggressive pricing, innovative marketing and cash on delivery model. India is a young and aspiring country and young Indian”s preferences are going to be to increasingly shop online. E-commerce never took off initially in India due to less penetration of computers and online casino dgfev internet and averse-ness to buying online with credit cards. With the explosion of mobile telephony and penetration of smart phones and 3G, M-commerce has become a reality. Cash on delivery is an important enabling change to the business model that Flipkart has done to adapt to the Indian market.

Flipkart is well-funded and probably will not need leverage to fund their growth.

On a forward looking basis on FY 2015 estimates, if you compared Flipkart with the top 3 listed retail players then Flipkart is trading at Enterprise Value / Sales of 1.6 times whereas the listed players Future Retail is trading at 0.7 times, Shoppers stop is trading at 0.74 times & Trent trades at 1.24 times.

Conclusion

On parameters of growth outlook, business model and balance sheet strength Flipkart scored hands down over the listed peers. Current profits and profitability is where it falters. However, if it does turn a corner in next 2 years. It might not look as expensive as it is looking right now.

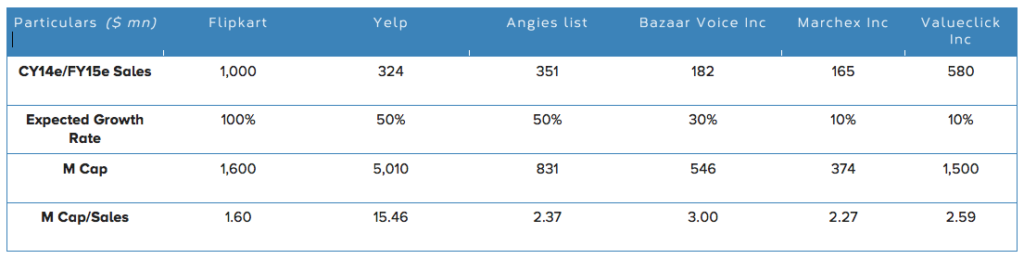

Even though Flipkart valuations are apparently expensive, they might not be all that crazy. A look at international comparative will give a good perspective.

While the valuations of listed peers are surely on the lower side but probably justified until fundamentals change for the better.