By Pranav Mehta and Neel Shah

Executive Summary:

The AMC industry in India has seen exponential growth in the last couple of decades. From less than Rs. 1 lakh cr at the turn of the century, the Indian AMC industry today boasts of an AUM of more than Rs. 30 lakh cr. However, by all accounts, we have just scratched the surface in terms of the potential growth of this industry. Buzz words like “under penetration” and “financialization of savings” get thrown around a lot during any discussion on AMCs in India. Via this deep dive into the AMC industry, we try to understand these and many other drivers of the industry. Fundamentally, we try to answer a couple of key questions –

1. Indian AMC industry will grow, but can it grow profitably?

We are confident that this industry can grow at 15%+ for a long time due to a variety of growth drivers discussed in detail in this study. However, certain concerns have emerged in recent years on profitability, especially considering the global experience. Globally, this industry is now at a much more mature stage of growth and grappling with profitability pressures like the rise of passive flows. Our study finds that while the global AMC industry will continue to struggle for profitability, the Indian AMC industry should be able to protect its profitability for few more years at the very least.

2. If yes, what is the best way to play this theme?

Having answered fundamental questions about growth and profitability, we dig deeper into the AMC business model to understand which kind of model to bet on – bank backed AMC or foreign AMC? Large AMC or small AMC? How important is performance, brand, and various other factors in the success/failure of an AMC? Our study finds that scale is very important in the AMC business. Large AMCs backed by bank-led distribution are best placed to grow at a good pace while maintaining best in class profitability.

We believe that this sector has a long runway of profitable growth. Our findings reinforce our bullish view on this space.

DEEP DIVE INTO THE AMC INDUSTRY

What comes to our mind when we think of AMCs in India?

Probably a lot of these cool sounding things –

Seems like a very exciting opportunity!

But before getting into India, lets first have a look at the key global data and trends.

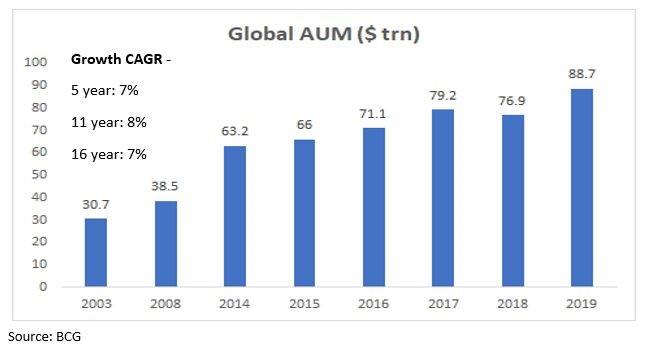

Global Asset Management AUM

The global asset management industry’s Asset Under Management (AUM) has been growing at ~7-8% CAGR. As of 2019, global AUM was more than $88tn vs $63tn as of 2014.

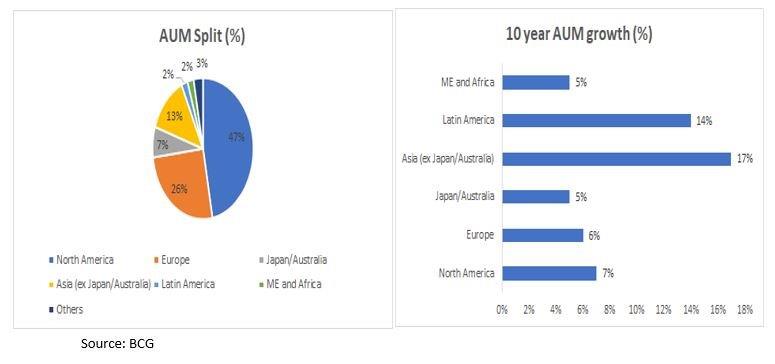

AUM split and growth by key regions

A major chunk of this global AUM is concentrated in North America and Europe. But Asia and Latin America are the fastest growing geographies with Asia growing at 17% CAGR over last 10 years.

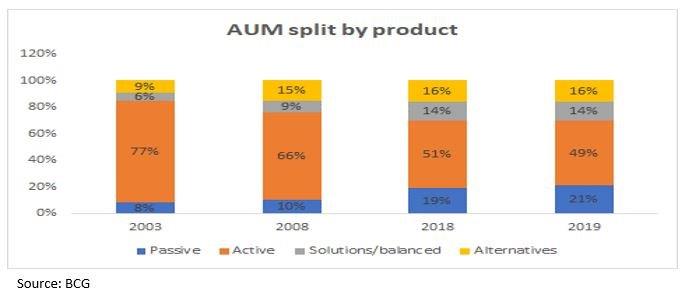

AUM split by product

Over the last 15+ years, the share of passive AUM has gone up from 8% to 21%, whereas the share of active AUM has gone down from 77% to 49%.

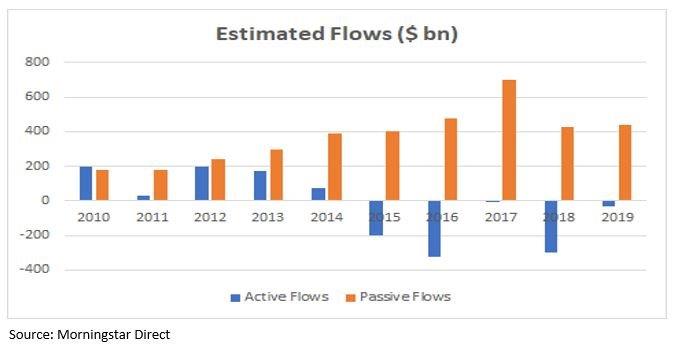

Flows split by style (only for USA)

From 2010-19, passive funds had inflows of $3.8 trn, while actively managed funds had outflows of $185 bn.

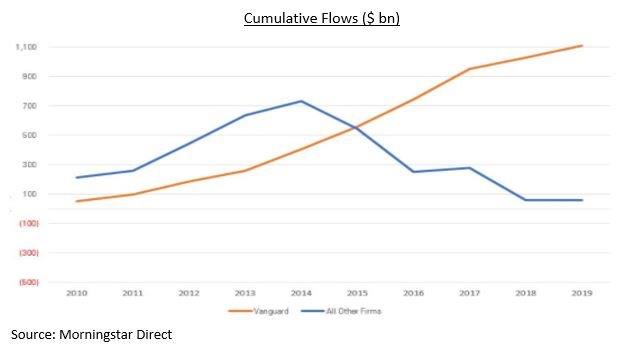

The Vanguard decade

As passive flows in the industry picked up, Vanguard was a big beneficiary. It collected about $1.1 trillion during the decade, while the rest of the industry combined took in less than $100 billion net!!!

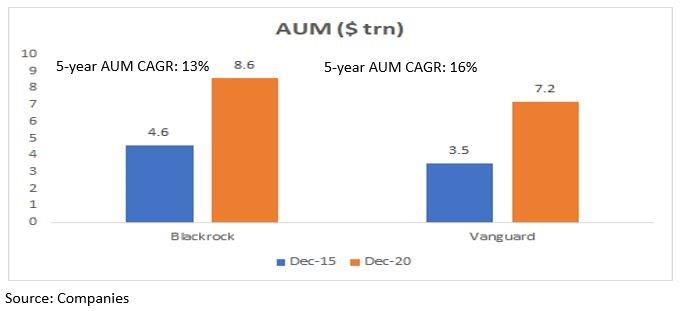

Industry becoming more and more concentrated

Blackrock + Vanguard (top 2 global AMCs) share in global AUM has increased from 12% in 2015 to 16% in 2020.

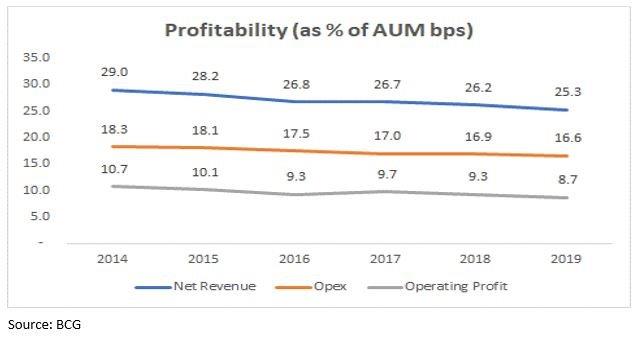

All these factors have put pressure on profitability…

Note: Based on data of top 100 global asset managers which represents more than 60% of global AUM.

AMCs typically earn significantly lesser fees from passive funds as compared to active funds. So, with huge flows seen in passive funds, profitability of AMCs has been under immense pressure in the last decade.

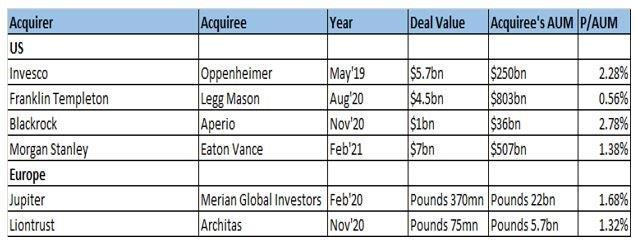

This has led to consolidation in the industry. In recent years, many M&A deals were observed in the industry with many big players like Oppenheimer and Eaton Vance being bought out.

Summary of key global trends

– Overall AUM growth rates have been at ~7-8% for the last 15-20 years.

– Asia (ex-Japan and Australia) and Latin America are the fastest growing regions with 14-17% long term growth.

– Shift from active to passive investing is the megatrend in the industry. The numbers for passive flows in the last decade are simply stunning!

– This has led to significant pressure on profitability of AMCs due to downward pressure on fees, leading to consolidation in the industry.

– Top AMCs like Blackrock and Vanguard have capitalized on the passive trend to grow much faster.

OVERALL, IT SEEMS THAT GLOBAL AMCs’ P&L IS UNDER SIGNIFICANT STRAIN. PROFIT GROWTH IS EXPECTED TO BE MUCH LOWER THAN AUM GROWTH.

Considering these global trends, should we still be as excited about the India opportunity?

Indian AMC Industry

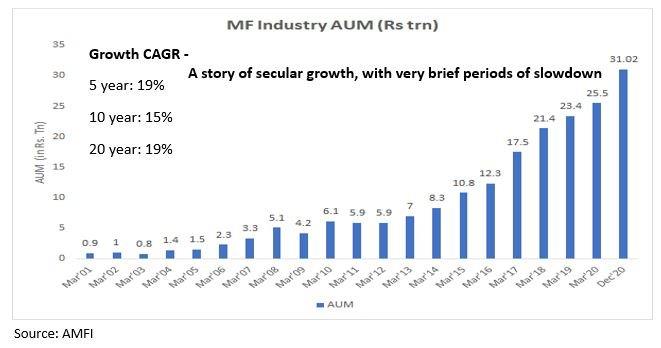

Historical Growth

Indian MF AUM has grown at a healthy pace in the last 20 years with very brief periods of slowdown. Over the last 5 years it has grown at 19% CAGR to reach Rs.31tn which was a mere Rs.6tn in 2011.

But despite this growth, the industry is still underpenetrated.

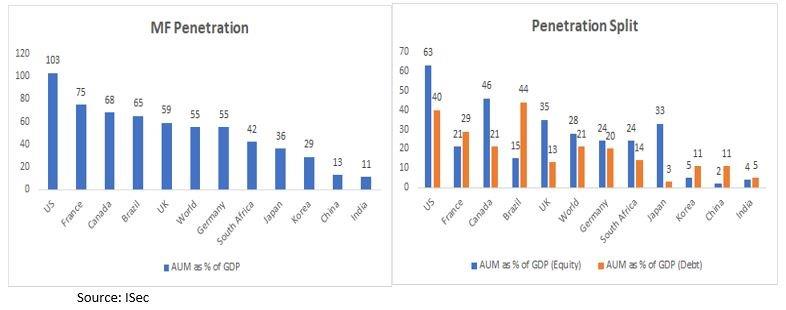

India’s AUM to GDP ratio is one of the lowest in the world.

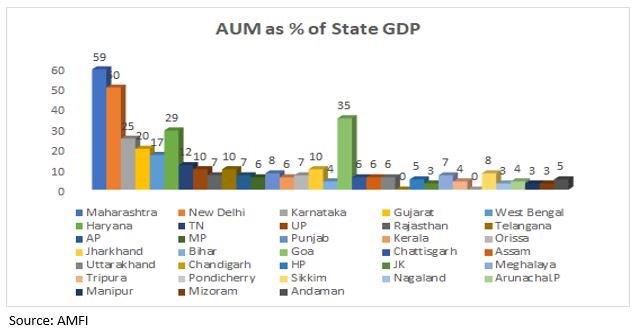

Under-penetration (state wise)

An analysis of state-wise penetration data reveals that only a handful of states in the country are well penetrated. Most of the smaller states fall way below the national average.

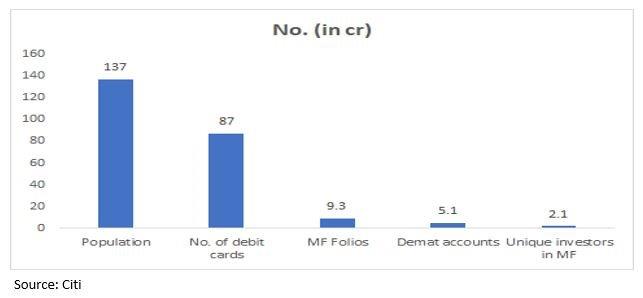

Various accounts

India has just 2.1 cr unique MF investors (9.3 cr total MF folios). We have barely scratched the surface!

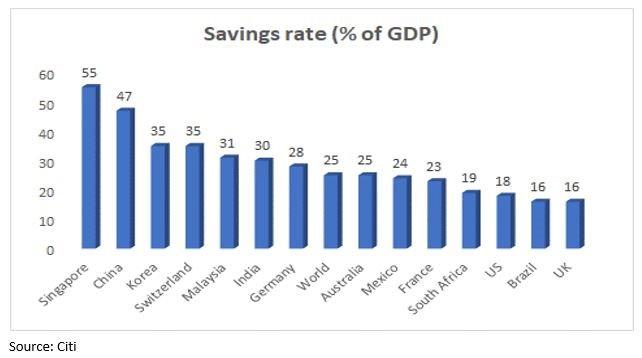

In India, under-penetration is combined with high savings rate – a good combination to have!

Savings rate

But how does India save?

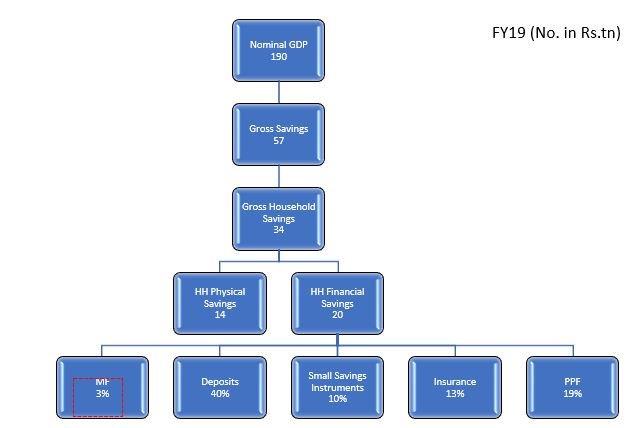

For illustration, let us look at FY19 nos.

In FY19, ~58% of gross household savings flew into financial savings. However, only 3% of household financial savings found its way into MFs.

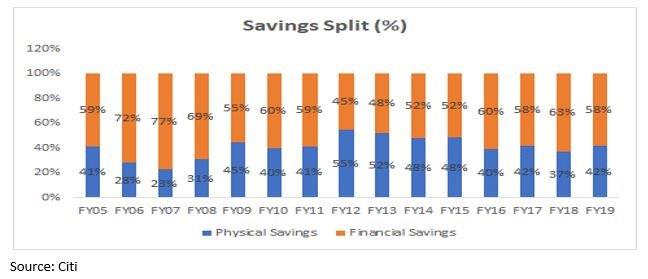

Financialization of savings – Cyclical or structural?

The share of physical and financial savings in the total savings pie keeps fluctuating, reflecting a cyclical nature. To illustrate, share of financial savings in total savings was as high as 77% in FY07, as low as 45% in FY12 and settled at 58-80% in last few years.

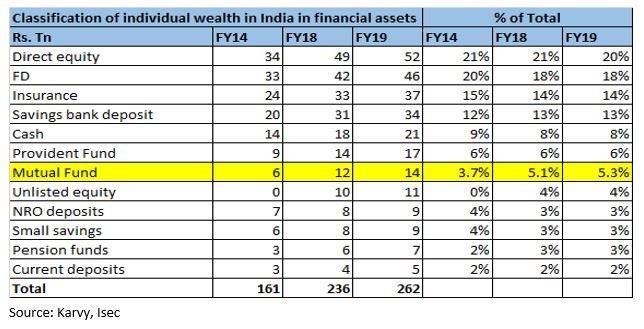

There is a bigger opportunity out there for MFs – taking share away from other financial assets.

Big opportunity – taking share away from other financial assets.

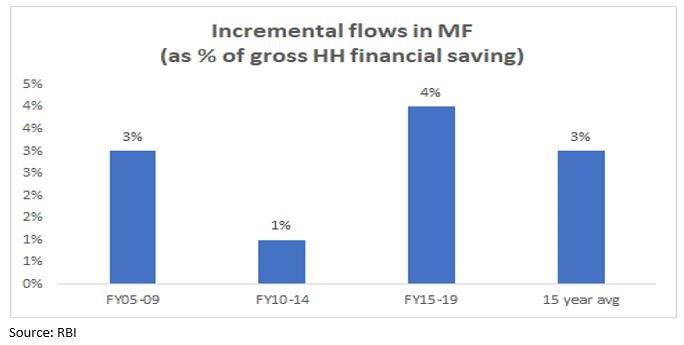

In the last 15 years, only 3% of incremental gross household financial savings has flown into MFs and only 5% of individual financial wealth in India is in MFs.

Under-penetration + high savings rate + scope for market share gains = long growth runway for AMCs.

The above factors plus a historical 1.4x multiplier on nominal GDP growth gives confidence of 15%+ long term AUM growth.

However, near term cyclicality will always be a factor.

But what about the profitability question?

What about the global megatrend of rising passive/ETF flows and lower fees?

To answer these questions, first let’s understand how does an AMC earn fees?

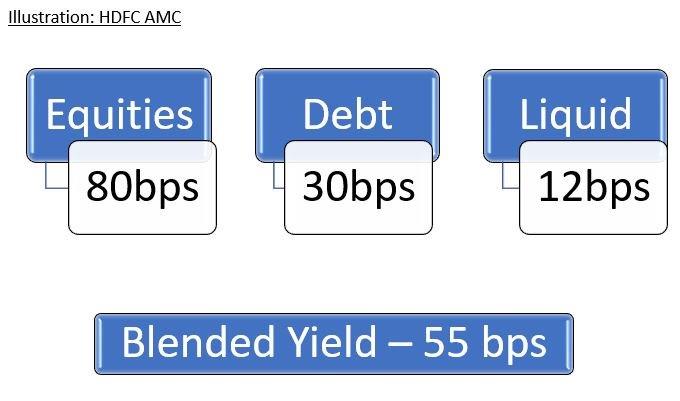

Active equity funds generate the highest fees while liquid funds generate the lowest of the three. Passive funds have significantly lower fees across all categories.

Impact on profitability can come from –

– Rising share of passive/ETFs

– Mix change from equity towards debt or liquid

– Any cut in Total Expense Ratio (TER) for equity funds

Let us take a look at these factors one by one…

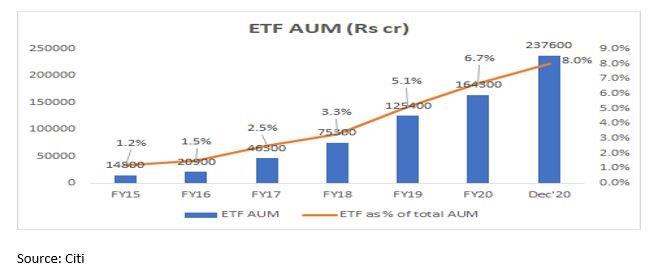

– Growth of ETFs in India

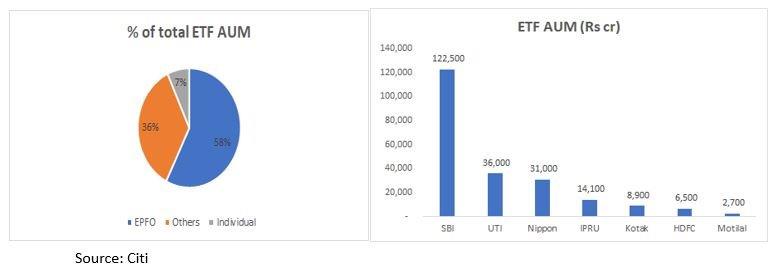

ETF AUM has grown exponentially to Rs. 2.3 trn (~8% of total AMC AUM)

Scary? Cause for concern? Not really.

In India, ETF AUM is restricted largely to EPFO and other wholesale (primarily Government) channels. EPFO can invest 85% of its annual deposits in debt instruments and the remaining 15% in equity invested via ETFs. SBI MF and UTI MF run the EPFO mandate and share AUM in the ratio of 3:1.

Pure retail flows into ETF are miniscule and not gaining too much popularity as of now.

ETF AUM as % of AUM is significant for SBI MF (27%), UTI MF (22%) and Nippon (15%)

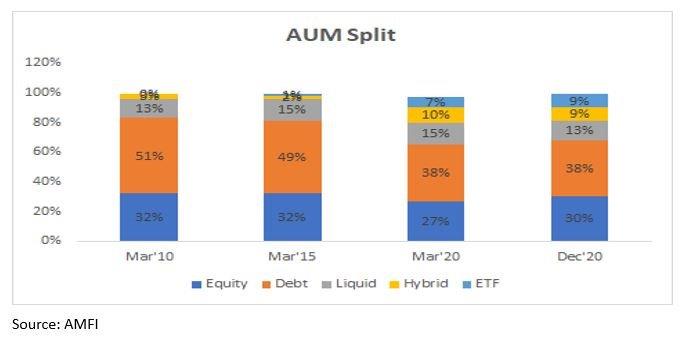

– Equity mix has been steady.

Share of equity has remained broadly stable over long term, short term fluctuations cannot be ruled out.

– History of TER tweaks by SEBI

– 2009 – Removal of entry loads on all MF schemes by SEBI

– 2012 – SEBI allowed AMCs to charge incremental expenses of 30 bps on new fund flows from B15 (beyond top-15) cities.

– 2018 – Reduced a 20bps permissible charge in case of mutual fund schemes where exit load is not levied to 5bps.

Issued revised terms and definitions and permitted additional TER of up to 30 bps for inflows from B30 cities instead of B15.

All commissions to be paid from the scheme P&L and distributor commissions to be only on a trail basis (no upfront commission).

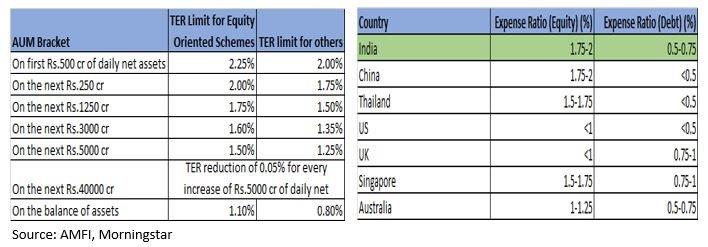

– 2019 – SEBI cut the TER chargeable to investors.

Not all tweaking by SEBI has been negative. Generally, they prefer to bring pricing down only after size of the industry has grown multifold. With the last round of TER cut happening in 2019, it is expected that the regulator will not engage in major pricing action for the next few years.

Is India’s TER higher than global standards?

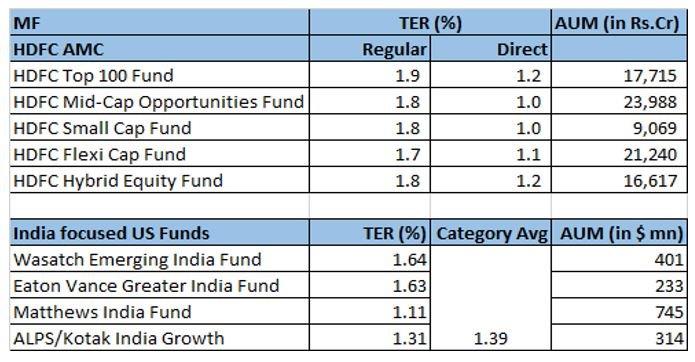

India’s TER is in line with most developing countries.

Some developed countries like US and UK have significantly lower TER. But if we look at India-focused funds in US, we see that the TER for these funds is in line with funds in India.

High pricing power>>TER cuts have been passed on

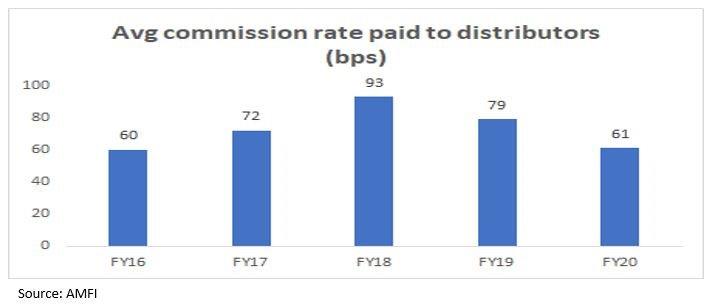

In any case, whenever SEBI has cut TER for the industry, most of the AMCs have been able to pass it on in the form of lower distributor commissions.

Risk: Threat of new competition/disruption

– In recent months, we have seen a plethora of companies applying for AMC license – Helios Capital, Alchemy Capital, Wizemarkets Analytics, Bajaj Finserv, Zerodha, Samco Securities, NJ India Invest etc. Some of the new applications follow SEBI’s move to ease the profitability criteria for setting up an AMC. In December 2020, SEBI said sponsors which don’t fulfill the profitability track record can still set up a fund house, provided they have a minimum net-worth of Rs 100 crore, instead of Rs 50 crore that is otherwise required. Some other companies like Groww and Flipkart founder Sachin Bansal’s Navi Technologies have taken the inorganic route to obtain a license.

– With the entry of these players, the competitive scenario is set to intensify. The new entrants will try to disrupt the distribution as well as fund management model prevalent in the industry. Given that active management is already a crowded market and the nascent stage of passive management in India, some players like Zerodha plan to exclusively focus on passive funds. Some degree of compression in yields due to new competition cannot be ruled out. However, in event of yield pressure, the distributor category will be more vulnerable given the AMCs’ dominant position in the industry chain. Also, incumbents have advantage of scale. As seen later in this study, it is very difficult to turn an AMC profitable at a smaller scale of AUM. That challenge awaits all the new entrants. Moreover, new entrants will expand the existing market which can in turn prove to be beneficial to the incumbents. For example, 65% of investors on Groww’s MF platform are first time investors.

Growth + Profitability is good.

So kya leneka?

By that, we don’t mean to give a stock tip. The focus of this study is to understand within AMCs, which is the right model to bet on – bank backed AMC or foreign AMC? Large AMC or small AMC?

For that, it is important to first understand the industry landscape.

Industry landscape

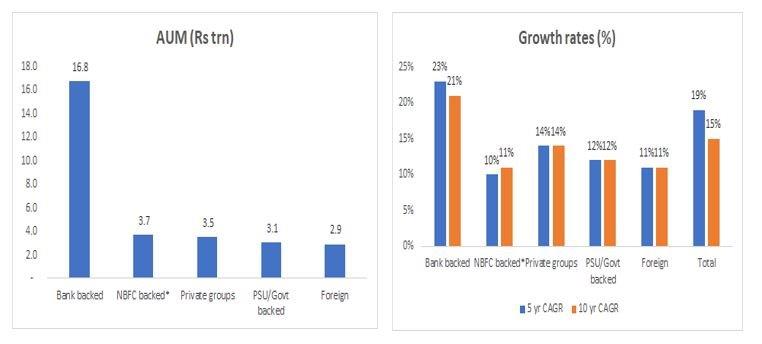

There are currently 42 AMCs operating in India. By ownership, they can be broadly split into –

– Bank backed – 11

– NBFC backed – 7

– Private groups – 10

– PSU/Govt backed – 5

– Foreign – 9

Who has been able to create scale?

*For this calculation, Nippon MF has been considered as NBFC backed AMC

Bank backed AMCs have grown the fastest; led by distribution benefits and strong brands. All other groups have grown at similar rates and are much smaller than bank backed AMCs. All other categories are in Rs. 3-3.5 trn range – in other words even smaller than one HDFC AMC!

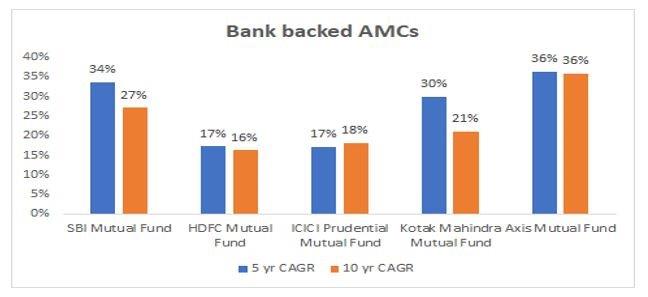

Growth in bank backed AMCs has been broad based. Axis has been the one with highest growth rate albeit with a lower base than its peers.

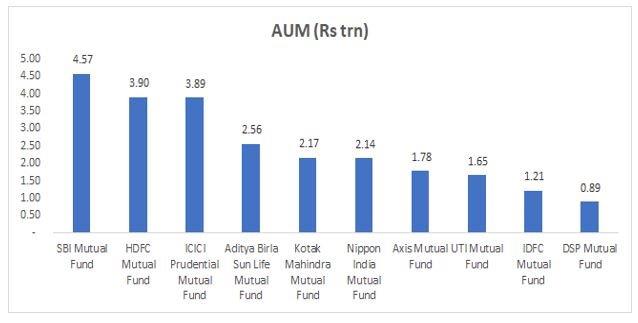

Top 10 AMCs dominate the market

Share of Top 10 AMCs has improved to 83% in 2020 vs 78% in 2015. Big players have grown bigger over the years.

What are the key drivers of growth?

– Distribution

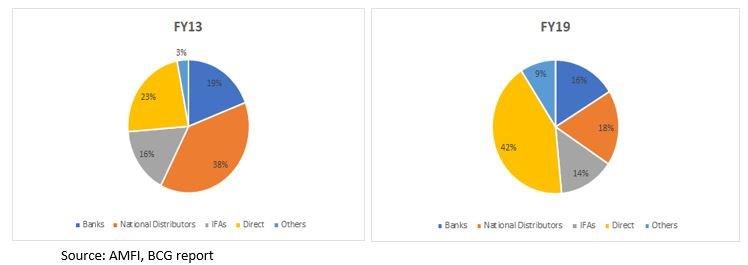

In recent years, Direct as a channel has grown by leaps and bounds whereas the share of other channels has come down. One thing to note here is that AMC profitability is not materially different in Direct vs Regular model. The distributor fee in the Regular model is passed on to customers in the Direct model in the form of lower TER. As Direct gains more share, it is the distributor that stands to lose the most.

– Brand

– Performance

How important is performance?

In the last few years, Axis MF and Mirae MF have been the standout AMCs in terms of scheme performance.

While Axis MF has grown at a healthy pace, Mirae MF has been the fastest growing AMC (organically) in the last 5 years.

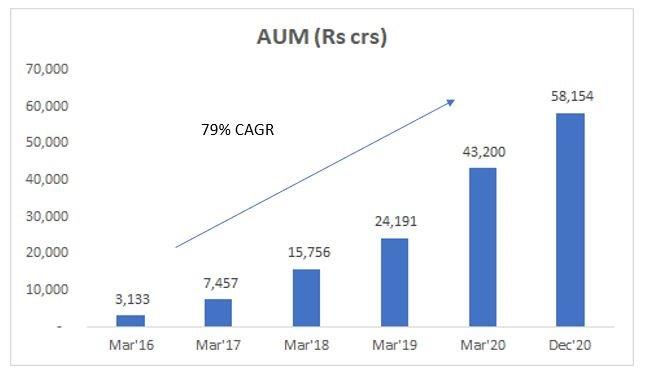

Case Study – Mirae Asset Mutual Fund

Mirae’s schemes have been in the top quartile in terms of performance across most categories in the past few years. Such level of stellar performance has enabled them to grow their AUM at a rapid 79% CAGR since 2016. Mirae is a rare example of a foreign AMC succeeding in scaling up their operations to a decent level in recent years.

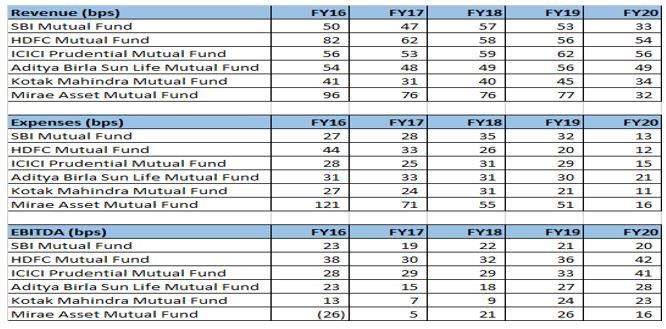

Mirae vs Top 5 MFs

While Mirae has seen a major improvement in profitability, it is still much lower than the Top 5 AMCs’ profitability (especially HDFC and ICICI MF).

The difference is on 2 counts – net revenue realization is much lower for Mirae presumably due to higher distributor payouts than large AMCs and due to scale benefits, larger AMCs have much better cost absorption.

If this is the differential in profitability with large AMCs for the best performing “small” AMC, then what about other small AMCs?

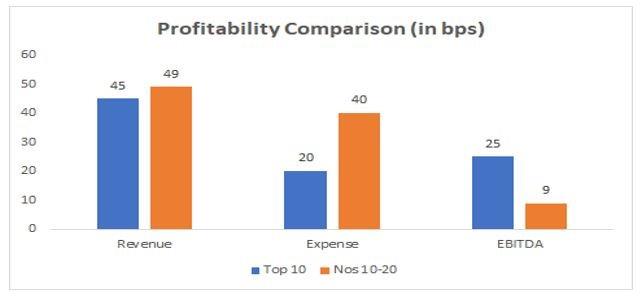

Avg profitability – Top 10 vs No10-20

Smaller AMCs command a slightly higher fee on average (maybe due to better equity mix) but have significantly weaker cost absorption as they lack the advantage of scale.

Conclusion: Size matters…. a lot!

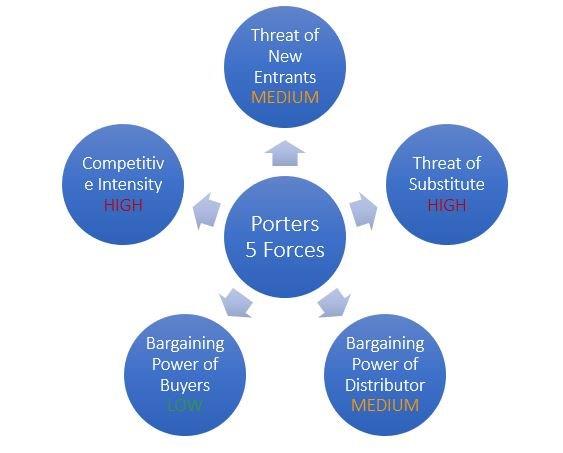

Porter’s Five Forces

Following are the key takeaways from a survey we conducted amongst distributors for this study –

Does it still make sense to sell MFs?

Yes. Still many opportunities to make good commission.

Which MFs are most popular/easily sold?

Despite underperformance, HDFC still remains most sought after. Additionally, there are always flavours of the season – Axis, Mirae.

Do clients care which MF you are investing in?

Most of them do care. Lot more push required for selling smaller/new funds.

What points do you consider while deciding which MF to invest in?

Commission, consistency, fund manager, brand

Which AMCs give highest commission to distributors?

Smaller AMCs like Mirae, Invesco continue giving good commissions as in the past. Least sharing done by HDFC, ICICI but those AMCs have biggest customer pull.

Does rising trend of direct investing pose a big problem for distributors?

Not really. Many a times customers who opted for Direct have moved back to advisors after having bad experiences.

Which MF does a client prefer – best brand or best performance?

Advisors generally create a portfolio with mix of both.

Any demand of ETFs from retail investors?

Sporadic enquiries. Nothing major.

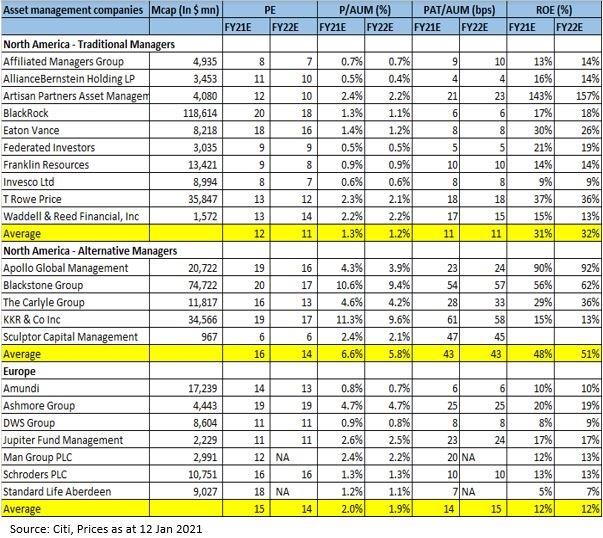

Valuations

Global Valuations

India Valuations

Global players command a significantly lower valuation as compared to Indian AMCs.

Why India deserves a premium valuation to the world?

– Higher growth (19% CAGR vs 7% CAGR for the world)

– Under-penetration

– Higher current profitability

– Fewer headwinds on future profitability

Conclusion

– Global AUM growth is 7%. But profit pool growing much slower.

– Indian AMC industry is set for strong growth of 15%+ for the next decade. However, growth will not be linear and prone to cycles.

– Indian AMCs are in a much better position to protect their profitability than global peers.

– Within Indian AMCs, the model to go for is large AMCs with strong brand and distribution backing like bank backed AMCs.

– Valuations look optically high for Indian AMCs. However, the premium to global peers seems justified due to superior growth and profitability.