By Sameer Shah and Pranav Mehta

RBI has responded to Covid situation in three installments so far. A summary of our assessment of the same

1. Change in stance

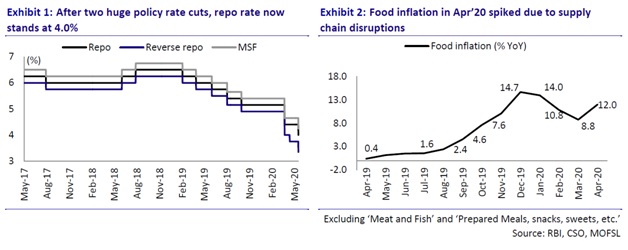

RBI has clearly changed its stance under the new Governor from inflation targeting to supporting growth as well. In fact, in the recent policy announcement, they have recognized the impact on growth is far higher than anticipated due to extended lockdown and hence announced an out of turn rate cut of 40 bps.

Hence in the near term, they have allowed real interest rates to turn negative anticipating inflation to come down once supply is restored. Economists say there is a further scope of reduction in interest rates to help revive growth given the moderate inflation expectations.

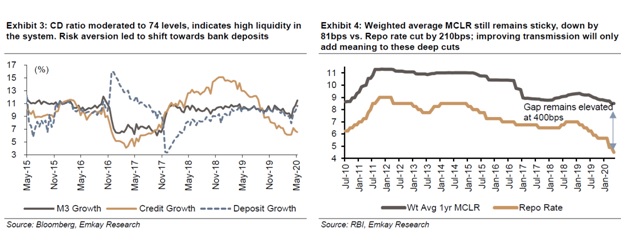

In addition to this, the government has yielded by reducing interest rates on small savings which has enabled banks to reduce the deposit rates to attract deposits. However, this benefit is only available to organizations where there is no trust deficit. Other banks/ NBFCs are not seeing the bonanza of deposit growth especially post Yes Bank saga.

The obvious negative impact is on the savers who will earn less post tax (hopefully just enough to beat inflation).

Second impact can be on foreign flows who may find rates unattractive given the currency risks. There has been an outflow from domestic bonds by FPIs (in line with rest of emerging markets) and what used to be a quota allocation has moved to a situation where FPIs are now utilizing only 48% of quota.

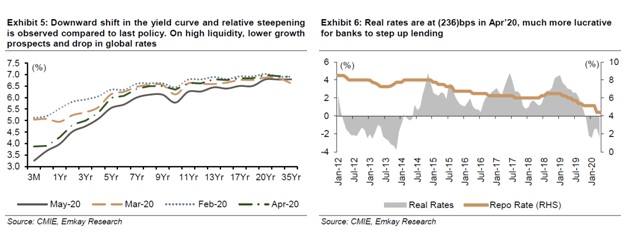

Lastly, the intended positive effect is not visible on bond market because of reluctance of banks to reduce deposit rates earlier and fear of crowding out by the government.

2. Liquidity measures

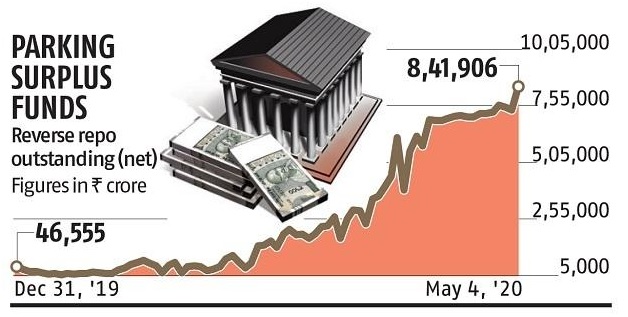

Cut in reverse repo to 3.35% – clearly there is more than adequate liquidity in the system, but as discussed above, banks have been reluctant to lend and have preferred to park excess liquidity with RBI. RBI on its part, has reduced reverse repo rate substantially to disincentivize this and force the banks to lend.

RBI has so far announced liquidity measures to the extent of Rs. 9.6 trillion. Governor also continued to stick to his phrase that “we would do whatever it takes” indicating that more measures will be announced if need be. Some of the significant measures include

– Reducing CRR for all banks by 100 bps

– Continued OMO purchases

– Liquidity measures through LTRO. Specifically introduced TLTRO in previous tranche – 50000 cr – to be given to microfinance, small and medium NBFCs

– Refinancing for AIFIs – a sum of of 50000 cr available to Nabard, SIDBI and NHB to meet sectoral objectives (though time frame of 3 months and has been extended by another 3 months)

– LCR requirement reduced from 100% to 80% (to be taken to 90% by Oct and 100% by Mar)

– Credit line of 15000 cr to Exim for 3 months which can be rolled over for 1 year

However, not all measures have yielded desired results. Banks have continued to remain risk averse

– Lower bids for TLTRO

– No excitement about refinance from SIDBI etc because of low tenure

– Funds parked with RBI continues to remain very high. Banks still have Rs. 7,50,000 cr parked with RBI (down from peak of Rs. 8,50,000 cr)

This has led to reduction in borrowing rates only for new borrowers and AA+ rated borrowers. Rest of the market still has a struggle to secure the borrowing lines given the banks’ risk averseness.

The 1 year median marginal cost of funds-based lending rate (MCLR) declined by 90 bps (February 2019-May 15, 2020). The weighted average lending rate (WALR) on fresh rupee loans has cumulatively declined by 114 bps since February 2019, of which 43 bps decline occurred in March 2020 alone. The WALR on outstanding rupee loans declined by 29 bps during October 2019-March 2020

3. Financial stability

Inspite of having the resources, there is a striking difference between the Fed and RBI approach where the Fed has stepped in directly and is using its own balance sheet to ensure financial stability and is also supporting the government in pushing their objectives.

Larger Banks/ NBFCs defaulting continues to be a threat and lot of organisations are in precarious situation. There will be significant second order impacts of this. Public sector banks will keep getting survival capital and will not be in any position to be economic drivers for a long time.

As the Yes Bank case has shown, both RBI and government have avoided the moral hazard of taking it up on their own balance sheet to avert systemic issues. Question is whether troubled entities will get required capital to survive or will asset liability mismatch blow some of these organizations up? Moratorium has actually pushed the issue. Restructuring will further kick the can down the road but real solution – capital is still elusive.

However, the Government has taken some steps in this regard and seems to have found a way around. Measures announced in the last round provides for creation of SPV which will get funds from RBI and funds (upto Rs. 30,000 crs) will be used to buy investment rated debt of NBFCs. It is an indirect way of RBI buying debt of NBFCs but for short term (residual maturity of less than 3 months)

Results of the same will be seen in coming months and depends on the fine print and operational implementation.

4. NPAs and moratorium

The problems are now compounded by lockdown which can significantly increase system level GNPA and can lead to even doubling of NPAs in certain segments like MSME (Current MSME GNPA is 2.3 lakh cr and a CIBIL report says that an equal amount is at risk of slipping into NPA). So banks/ NBFCs are now in collection and survival mode. Some areas of stress adding to the real estate led issues – asset financiers, microfinance, SME loans and segments of retail loans. Least affected would be retail home loans and gold loans at this point. Moratorium has compounded the problem.

– Moratorium of 3 months extended by another 3 months till 31st August.

– Interest on moratorium loan to be repaid by March instead of balloon payment at the end of moratorium period

Large portions of books are under moratorium already. NBFCs have a higher share of book under moratorium and are hence, more exposed to the moral hazard risk.

Our thoughts on the moratorium situation –

We are in an unprecedented situation with no past precedent of such large scale moratorium. It is difficult to predict customer behavior. We feel behavior (post moratorium) will depend on following factors –

- Extent of economic recovery.

- Availability of financing from various sources like the MSME credit guarantee scheme.

- Nature of loan – security, tenure etc.

Our base case assumption at the moment is that longer the tenure of moratorium higher the collection risks for banks and NBFCs once moratorium is lifted. There is scope for positive surprise on this front if we see a V shaped economic recovery in coming months.

While banks are demanding one time restructuring of loans, we remain skeptical about the implementation of such schemes as past experience with restructuring has shown that it only kicks the can down the road.

On asset quality front, the biggest measure has been taken for regular SME accounts. Government has guaranteed incremental loans upto 3,00,000 cr.

Details of the package:

1) Administered through NCGTC

2) Unsecured no questions asked loans upto 20% of outstanding credit or Rs. 25 cr whichever is lower.

3) 100% sovereign credit guarantee

4) 4 year tenure. 1 year moratorium

5) Interest rate cap: 9.25% for banks and 14% for NBFCs

Due to 100% credit guarantee banks are expected to disburse loans under this scheme which should help restart the MSME engine. However, results of the same will be seen in coming months and depends on the fine print and operational implementation.

5. State governments

– Relaxation of rules wrt withdrawal from sinking fund will allow states to withdraw an additional Rs. 13,300 crs. This accounts for 10% of the states’ FY21 redemptions. Including the normally permissible withdrawal limit, this measure would enable the states to cover about 45% of their redemptions totaling ~INR1.4t in FY21.

Conclusion:

Impact on economy:

RBI’s measures will bring down overall interest rates in the economy. With real rates negative, there is enough push to the banks to restart the lending engine. However, RBI measures are not enough to correct the risk averseness in the system which remains the biggest bottleneck to lending growth.

With RBI cutting rates and banks sitting on excess liquidity, we expect accelerated transmission of rates going forward.

There can be negative implications of lower interest rates on domestic savers and FPI flows in the debt market.

Impact on banks and NBFC stocks:

Markets never like uncertainty. This extended lockdown and moratorium has created uncertainty as to actual level of NPAs. Reported P&Ls are meaningless for the next few quarters and market will start focusing on other factors like collection efficiency, extent of book under moratorium, contingency provisions etc.

We expect financial companies’ stocks to remain under pressure till the time clarity emerges on the actual level of losses that they have to take. Future RBI measures (if any) like one time restructuring can further muddle the waters. Positive surprise can come if there is a V shaped economic recovery and there is only a modest increase in NPAs.