This interview appeared in the ET Prime on 5th January, 2023 (link)

India is the global back-office and world’s pharmacy, says Ravi Dharamshi, founder and CIO, ValueQuest, speaking about IT and pharma sectors – the two top themes of the last two decades.

In conversation with Ami Shah, he talks about the SCALE framework of investing, stock-market lessons learnt from Warren Buffett and late Rakesh Jhunjhunwala, and things that motivate him.

Are you a value or a growth investor? Why do you say that?

We honestly do not wish to get stuck or typecast in the nomenclatures of growth or value. ValueQuest means itself the quest for value. Growth is inherent and an integral part of value realisation. Lot of value stems from the future growth. Our approach has been to find companies that are on the cusp of a growth phase and identify them before the market has baked the future expectations into the price.

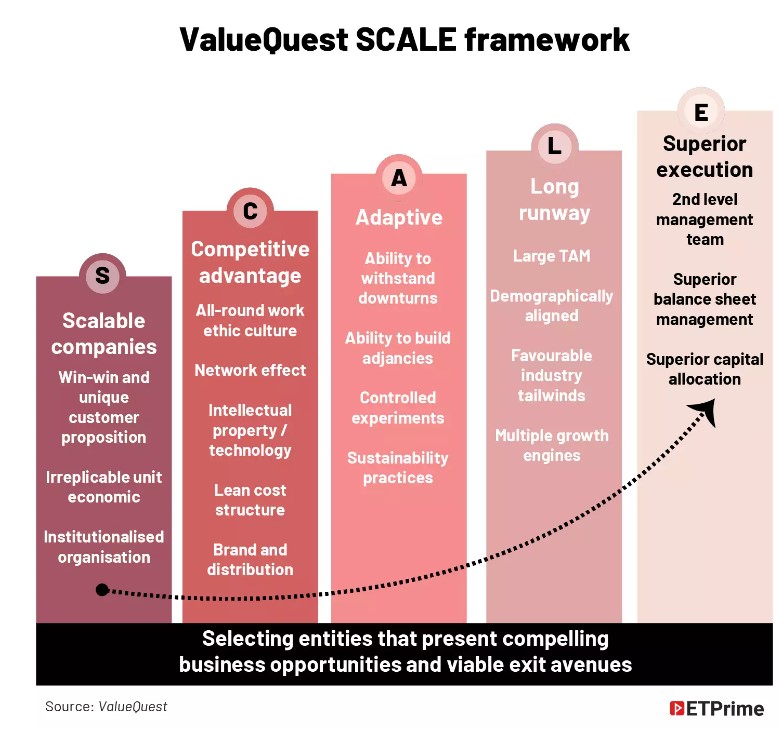

Our goal is to identify ideas or themes that will do well in the foreseeable future of 3-5 years. Connecting the dots top-down, we set out to look for best companies which can capture the opportunity in this theme, and in the process change the SCALE of the company itself.

SCALE framework: Scalable companies with sustainable Competitive advantage, Adaptive on a Long runway with superior Execution capabilities. We believe this is the phase wherein maximum wealth creation happens for a company and that is what we aspire to capture.

What are your learnings from a value investor like Warren Buffett? He also bought Apple at its peak and today it accounts for 40% of his portfolio.

Warren Buffett is the fountainhead of investment learning and lessons and there is so much one can learn and imbibe. For a fund manager or even a normal investor to imbibe his thought process to whatever extent possible should be the first step in the journey of wealth creation.

His quotes and sayings are investment folklore and there are no qualms for us to say that we use his quotes wherever and whenever possible. There is so much wisdom packed into few words.

But from the above example or question, I think the biggest learning is that he is not afraid to change his mind and views and admit his mistakes. From not being too keen on technology companies for various reasons and not having any in his portfolio to having his largest holding in Apple, which has rewarded him well. His flip flops on the airline industry are also well known and his letters to shareholders are full of self-deprecating humour, which is refreshing and brings out a character of humility that is so critical in the investment world.

What according to you were the top 3-5 themes for the last decade?

Two top themes in the last two decades have been IT and pharma. Both industries have gone through the cycle of discovery where cost efficiencies and technical edges were explored and exploited to the cycle of growth. They went through periods of consolidation and eventually innovation and only the best survived. Finally, they are closer to the mature stage in terms of growth and return on capital.

These industries have proved themselves to the world and put India on the map with their scale and ability to seize the opportunity as and when they were presented, be it Y2K or Covid-19. These have also been rewarding investors, with IT giving a 17% CAGR over the past two decades. India has gone on to become the global back-office and the world’s pharmacy.

How important is ESG in your investment philosophy? What are the parameters you look at?

Mark Twain, famously mentioned in his autobiography, “There is no such thing as a new idea. It is impossible. We simply take a lot of old ideas and put them into a sort of mental kaleidoscope. We give them a turn and they make new and curious combinations. We keep on turning and making new combinations indefinitely; but they are the same old pieces of coloured glass that have been in use through all the ages.”

ESG or Environmental, Social and Governance is one such old cocktail. It’s the latest buzzword in the investing world, even if it’s not really new, is one such old idea that is being put through a different lens, every few years.

It will be safe to assume that companies and decision makers, who have a fiduciary responsibility to maximise profit or shareholder value, are incentivised for better performance. However, its very tough to assume they to work solely with the higher goals of ESG in mind and not worry about shareholder satisfaction.

On the other side, societal expectations and requirements for a sustainable future are absolutely essential and need a lot of focused attention and questions asked. However, the definition of sustainability and its framework may differ from country to country and company to company. Further, ESG non-compliance will probably be a key factor going ahead in raising funds/investments and tapping other markets or avenues.

As an investor, having a feel-good factor that you are participating in the change, which is good for the future, may not be the most best investment for returns per se and one may have to walk a thin line between the high road and high returns.

So, it’s our endeavour to find such companies and themes that will benefit in the move towards ESG compliance — be it a transition to renewable energies and ancillary businesses around this.

Which are the new themes that you are exploring seriously?

We have entered exciting times post-Covid-19. As I have mentioned in of our earlier posts, “This is the manufacturing renaissance for India”. There is a shift in the world order and there is a need across the globe to look for alternate suppliers or manufacturers to the products needed by the world. Days of China being the lowest cost and most reliable supplier to the world are incrementally over. Also, the world has realised how much it depends on China. So, the need to reduce dependence is clear and present. Be it in industries as diverse as chemicals or smartphones, the theme of China + 1 will not be a temporary one, but a paradigm shift is on the way. For example, India has replaced Vietnam as the world’s second-largest mobile phone manufacturer. Between 2016 and 2022, India is expected to attract investments worth INR44,265 crore in the smartphone manufacturing sector.

From just three mobile manufacturing units in 2014, India witnessed a jump to 268 smartphone and allied services manufacturing units until 2018.

This has also been massively aided by schemes and intent of the government in its endeavour for Atmanirbharta, be it in defence, textiles, electronics or capital goods. Schemes like PLI have further bolstered Indian companies to relook and enhance manufacturing and reclaim the market share lost to China and Vietnam.

Another theme, which has been very interesting in the last few years but has really come to the fore since the Russia-Ukraine war is the transition away from fossil fuels. Energy literally came under fire and while the push for reduction of dependence of imported fuel has been a long-standing push, the impetus towards renewables, be it solar, wind or even hydrogen, has been extremely high. This and its ancillary businesses could be a great idea for the future.

How do you look at high PE stocks in terms of quality stocks? When should investors completely ignore high PE stocks?

My first boss and my mentor, Late Rakesh Jhunjhunwala, always used to say it’s more important to buy at the right price. He often used to say, “Never invest at unreasonable valuations. Never run for companies which are in limelight.” He strictly followed this rule and used to advise New Age investors to look at stock valuations before making any investment decision. This holds true even in today’s world of high-priced IPOs and we have seen how that has played out for some of them. While they may be good businesses, it’s not necessary that good businesses bought at any prices or unreasonable valuations will be rewarding for investors. Having said that, there is a certain higher PE command for high quality stocks, these 50x, 55x, 60x multiples can be a bit misleading. They also need to factor in the future growth possibilities for an investor.

Markets give higher multiple to businesses with:

- Higher predictability

- Higher profitability

- Higher growth and longer runway

- Higher sustainability of profits due to competitive advantages

So, as Warren Buffett changed his approach from an absolute cigar butt-oriented value investing to Phil Fisher approach of buying superior companies.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett

We also believe in buying superior quality companies, but even that has an entry multiple to it. Valuations do form a major portion of future returns.

One must ensure not to end up giving a high multiple to a business which is sub-scale, sub-quality and where profits are not sustainable due to cyclicality or other reasons.

Given a chance would you prefer to be a highly concentrated investor?

Higher concentrated bets and a low churn rate are our most favoured and ideal scenario. Here also I would like to quote the Oracle of Omaha, “Diversification may preserve wealth, but concentration builds wealth.”

The level of concentration is a matter of personal choice and ability to withstand market vagaries. It is a question of your ability to hold positions for long periods of time. If an external event can force your hand at the wrong time, then you are better of more diversified. We believe 8-12 stocks is ideal concentration for a portfolio.

Do you believe in timing the market? If yes, how do you do it?

“Time in the market is more important than timing the market.” However, when Buffett urges you to buy, when everyone is fearful and sell when everyone is greedy, is also essentially a way to time the market. We wish to be long-term greedy. Our time horizon is 3-5 years. We usually have one 30% correction, two 20% correction and three-five 10% corrections in a 5-year horizon. Our aim is not to get every correction right. But when opportunity presents itself, it is our duty to take that advantage.

We try to be on the right side of the trend and within that we stay invested if the stock and business fit in our hypothesis and valuation matrix. We don’t try and get the bottoms and we certainly don’t try and judge the tops. We hope we can buy reasonably good businesses in an emerging theme, and we hope the business can grow to its potential. We cannot have an investing strategy that focuses on the extremes of the market all the time. In fact, focusing on the same can be very counter-productive. Every future market correction seems like a threat and every past market correction was an opportunity in hindsight. If we give up our obsession with finding the extremes in the market, it will take away most of our worries.

How seriously you look at macro-economic issues. How do you factor it into the investment philosophy?

There is no doubt that macroeconomics plays a very important part in the evaluation of a business, and also how they will impact the market scenario. In fact, the recent memo of Howard Marks is an excellent representation of this — how the macro-economic factors, say interest rates, have impacted and affected asset classes and eventually market performances over the past 2-4 decades. Having said that, investing is part science and part art, and we have seen countless examples of this. In a favourable environment in 2017-18, while the world outperformed, India was dealing with more structural changes that gave us short-term pains. But on the long run, there’s a promise to become invaluable and eventually, as we call it at ValueQuest, it will make India ‘anti-fragile’ to some of the global macroeconomic headwinds.

Further it’s our goal to not look at day-to-day weather patterns but seasonal changes. This broad understanding of the season we are in, whether it’s time to be more aggressive or defensive. Our macroeconomic study is to ensure that we are factoring in the right models and frameworks given the seasons versus the variables of day-to-day weather vagaries.

What are your parameters for investing into deep-value stocks? How do you analyse the promoter?

Since we do not label stocks into growth or value paradigm, our parameters for investing do not change. Broadly, business, promoter/management and valuations remain the criteria for investing. However, in case of smaller companies, promoter/management have far higher weightage in terms of significance.

Our framework for analysing any company management broadly follows:

Integrity – Judged through past actions

Competency – Judged through ability to manage balance sheet during downturn, ability to gain market share, expand addressable opportunities

Alignment of interest – Judged through skin in the game, corporate structure and past actions related to minority shareholders

Allocation of capital – Ability to generate returns above cost of capital over a long term is the true test of any management.

What was the best book or article you read last year? Why did you like it?

It’s actually a re-read of a book. Reminiscences of a Stock Operator: The Life and Times of Jesse Livermore. This book is a wonderful read. No matter how many times you have read it, the book leaves with you some new lessons. Not so surprisingly, it has quotes and enough anecdotes that still resonate almost 100 years after it was first published.

This is the beauty of that book, and this is the beauty of the stock market. It generally repeats and rhymes. For example, one quote in the book reads, “Carefully laid plans will miscarry because the unexpected and even the expectable will happen.” And see how true this has been in the year gone by. Twelve months ago, we were on the way of a commodity supercycle, today we are struggling with a possibility of recession. A year back, we were on the steroids of “free, easy, fast” money, today we are looking at rising interest rates, QT and a much-needed funding winter. Today, its king dollar / rising yields and tomorrow it may be something else.

“The real key to making money in stocks is to not get scared out of them.” – Peter Lynch

Which sports you enjoy? Which match or event was memorable last year?

Year 2022 has been great for sports. I was lucky enough to catch the live India-Pakistan cricket match in Australia, and also witnessed one of the greatest football world cup finals in the history just recently. Both were absolutely enjoyable watch, and both were taken to the ultimate last minute to decide the winner. I have seen and played a lot of sports, but these both games were something else. The winner is sports and while there are so many lessons being eulogised, you cannot but not mention the never-say-die spirit of the runner ups in France and laud the genius and longevity of the career Lionel Messi has had. Hats off.

Which was your inspirational song last year?

So many. I am a complete music buff, and the taste varies from Kishore Kumar to Imagine Dragons. So, there is not a single song that I can pinpoint. However, Don’t Stop Believin’ by Journey is one of the better inspirational songs I have heard. As the lyrics go – Don’t stop Belivin, Hold on streetlights, People.

Name some movies or TV serials you have enjoyed over the last one year.

This year has been for sports documentaries and there have been so many good ones. Two that stand out are Swimmers and Rise, both are about migrants making it against all odds and succeeding under the most adverse circumstances.

Rise, particularly, has had a real fairytale ending with Giannis Antetokounmpo ending up as NBA world champion in 2021 and getting two-time MVP awards. His story, grit and determination has been certainly special.

Tell us your favourite stock market anecdote involving a colleague or an acquaintance.

There have been so many, but two are most memorable. In 2007, when I was in far more illustrious companies amongst the giants of our stock market, they made a statement that the market is going at 100 KM/hour and an accident is around the corner. This statement had so much wisdom and eventually when the global financial crisis precipitated, it made so much sense for a young inexperienced investor like me. This profound wisdom and the logic behind it will remain an eternal lesson for me.

My own small such experience was in the despair of Covid-19 where I publicly stated, “One should sell their house and buy stocks.” While I only meant it metaphorically and wanted to emphasise the opportunity that lay ahead, I got a bit of flak for it. Even though it eventually worked out superbly well for those who did invest in those times, it also taught me a good lesson on standing out on my own conviction and literally keeping my head when everyone was losing theirs.