The Union Budget for FY23-24 was presented against a backdrop of challenging global macros – slowing growth, high interest rates and inflation. The knock on effect on India is already visible in the form of weakening exports and higher import bill due to commodity inflation. Given this challenging situation, the Honorable Finance Minister did a commendable job of balancing fiscal discipline and growth requirements, while simultaneously taking further steps to promote domestic manufacturing which should help in correcting India’s trade deficit in the long term.

Post COVID, the Government has made an expansionary and credible turn in approach while presenting the Budget with no more “off-Budget” allocations and much more realistic revenue assumptions. The FY23-24 Budget math also followed the template of recent years with reasonable and conservative assumptions –

- 12% growth in net tax revenue vs 10.5% growth in nominal GDP indicating minimal tax buoyancy.

- Flat disinvestment target of Rs. 61,000 cr.

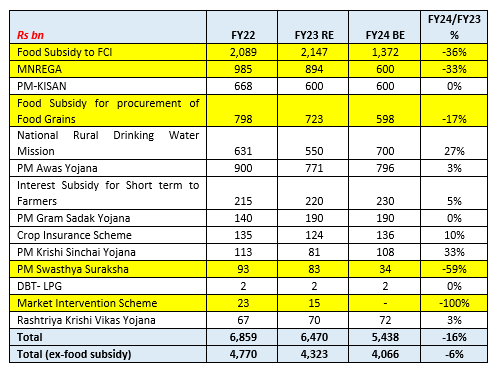

- Fiscal deficit target of 5.9% in FY24 BE vs 6.4% in FY23 RE. Improvement of 50 bps enabled almost entirely by reduction in subsidy bill on food and fertilizer.

The Budget mainly focused on 4 broad areas –

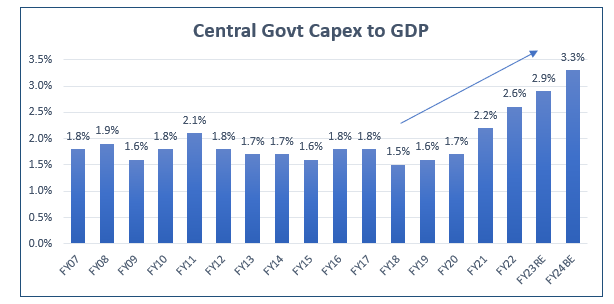

- Capex push – The Government budgeted for an extremely healthy 37% growth in capex in FY24 to Rs. 10 lakh cr. It is pertinent to note that Central Government capex spends have been going up significantly in recent years and is now expected to touch 3.3% of GDP (4.5% with IEBR) in FY24

The Central Government has been doing the heavy lifting on capex, but Central Government capex accounts for ~40% of total Government capex, with the rest being contributed by State Governments and Central PSUs.

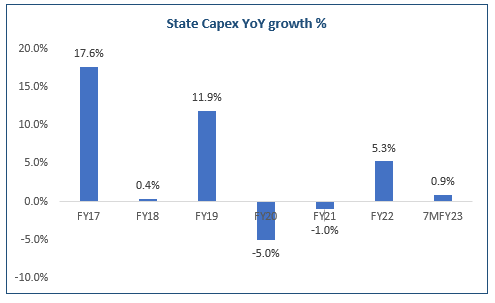

State Governments have been lagging in the execution of their capex targets and it is now time for them to also pick up the gauntlet on capex. It is hoped that with the improving fiscal health of states post COVID recovery, capex execution going forward will improve.

- Domestic manufacturing push – In line with the past steps of the Government like PLI schemes, few additional measures were announced to promote domestic manufacturing –

- Reduction in duties for components like open cells used in TV panels, camera lens and camera module, among others.

- Duty on electrical kitchen chimney increased to 15% from 7.5%, while duty on heat coils for use in manufacture of electric kitchen chimney is being reduced from 20% to 15%

- Reduction of basic custom duties on the seeds used in the manufacturing of lab grown diamonds from 5% to Nil.

- Energy transition – Various announcements were made in the Budget to support energy transition from traditional to renewable energy sources –

- Rs. 10,000 cr for constructing 500 new CBG plants under the GOBARdhan scheme.

- 5% CBG mandate will be introduced for all organizations marketing natural biogas.

- Excise duty exempted on GST paid CBG used for blending in compressed natural gas.

- Rs 20,700 cr renewable energy power evacuation project with 40% funding support from central government.

- National Green Hydrogen Mission – An outlay of Rs.19,700 cr to produce 50 Lakh Metric Ton of Green Hydrogen production annually by CY30.

- Rs. 30,000 cr capital support to OMCs as capital support for energy transition/net zero objectives.

- Battery energy storage systems with capacity of 4,000 MWH to be supported with viability gap funding.

- Customs duty exempted on import of capital goods and machinery required for manufacture of lithium ion cells for batteries used in electric vehicles.

- Direct tax changes – The Government has announced various tax cuts to nudge people to adopt the new tax regime. The resultant tax savings of Rs. 35,000 cr will benefit a large number of taxpayers and provide a boost to sentiments. Some of the measures announced for individuals opting for new tax regime–

- New tax regime to be default tax regime for individuals and HUFs.

- Limit of rebate increased from Rs. 5,00,000 to Rs. 7,00,000.

- Standard deduction of Rs. 50,000 introduced for salaried individuals.

- Maximum surcharge rate reduced from 37% to 25%, resulting in maximum effective tax coming down from 42% to 39%.

As discussed above, while the Budget focused on fiscally prudent, pro-growth measures, it was also heartening to observe no degree of populism in the budget, given that this was the last full budget pre-elections. In fact, there is a YoY decline in allocation to several welfare schemes in the Budget.

Overall, the FY23-24 Union Budget was a fiscally prudent Budget that focused on the key longer term focus areas of the Government – capex, domestic manufacturing, green energy transition – while providing some relief to the middle class via direct tax changes.

Portfolio Strategy

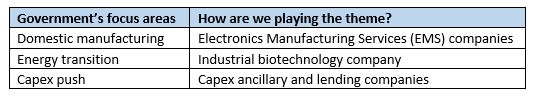

Our portfolio strategy is based on identifying various top down mega trends that we expect to play out over the next 3-5 years and then finding the most suitable bottom up idea to benefit from the trend. We do not view the Budget in isolation, but as part of the broader economic direction the Government wants to take over the medium term. In that context, we note that our portfolio is completely aligned to the Government’s focus areas –